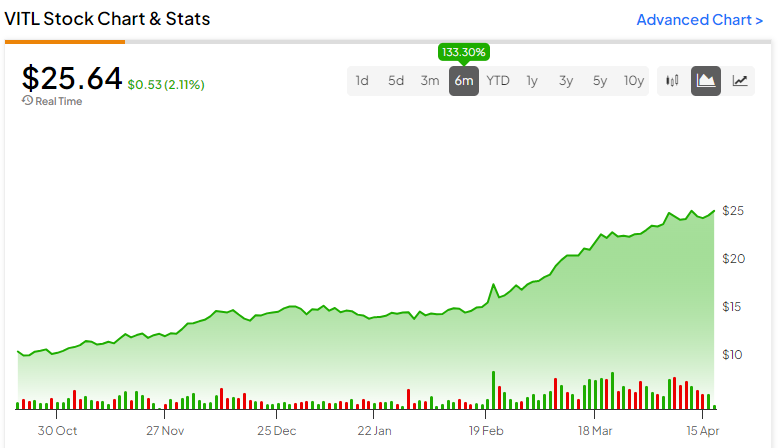

Vital Farms (New York Stock Exchange:VITL), the egg and dairy company offers an attractive investment opportunity in the growing trend of quality nutrition as consumers increasingly prioritize ethical sourcing and sustainable practices in their food choices It seems like it is. Vital Farms is capitalizing on this trend and rapidly expanding its revenue and profit margins. Although the stock’s valuation seems expensive after rising 133% in the past six months, I believe in its long-term prospects. Therefore, I am bullish on VITL stock.

Meeting the growing demand for quality nutrition and ethical sourcing

A key factor driving Vital Farms’ investment case is the continued rise in demand for high-quality nutritional and ethical sources due to increased consumer awareness of the quality of their food choices.

By offering pastured eggs sourced from small, family-owned farms, Vital Farms not only meets this demand for quality, but also supports the values of health-conscious consumers who demand transparency and ethical sourcing in their food. This is consistent with the view. This approach is in contrast to traditional egg collection methods, where chickens are usually confined in cages or indoor facilities.

Vital Farms has been successful in expanding its distribution network as consumers increasingly choose cage-free eggs over eggs sourced from caged hens. The company’s product range extends beyond shell eggs to hard-boiled and liquid whole eggs, and is currently available at his 24,000 retail outlets nationwide.

In addition to Vital Farms seizing the opportunity presented by the growing demand for organically produced, free-range eggs, my optimism also extends to the broader egg industry. I believe that the overall egg industry will continue to see strong growth in dollar terms, driven by the fact that eggs are increasingly viewed as a premium source of essential nutrients, including protein and a wide range of vitamins.

While the shell egg market is expected to grow at a decent compound annual growth rate (CAGR) of 2.8% through 2028, producers are , we’re starting to realize that pricing has a huge impact. This is even more true for companies like Vital Farms because of their ethical practices, which allows them to command premium prices.

Rapid company-wide growth, high profitability

The growing demand for cage-free eggs and Vital Farms’ strong pricing power have enabled the company to enjoy rapid overall growth and high profitability.

Specifically, the company has grown its revenue at a compound annual growth rate of 34.6% over the past five years. This momentum remains very strong, with revenues for fiscal 2023 increasing by 30.3% and excluding the additional 53rd week of the year increasing by 28.0%.

And to show that Vital Farms is benefiting equally from pricing power and strong demand for free-range chicken, take a look at the company’s most recent Q4 earnings growth numbers. Specifically, Vital Farms’ revenue growth for the quarter was driven by his $13.4 million increase in sales volume and his $12.4 million increase in price.

Meanwhile, increased production volumes and prices have also enabled the company to maintain industry-leading profit margins. For the past five years, Vital Farms has been able to maintain his gross profit hovering between 25% and 35%. This stands out favorably compared to its major competitors, whose gross margins vary widely. Moreover, the numbers often suggest narrow profitability, especially due to the nature of egg commercialization.

With strong sales growth and industry-leading profit margins, Vital Farms is recording profitability growth at a rapid pace. Adjusted EBITDA increased 198% to $48.3 million last year, and free cash flow reached a record high of $39.4 million, a significant improvement from -$18.7 million in fiscal 2022.

Is Vital Farms’ valuation inflated?

Despite Vital Farms’ strong sales and bottom line growth, the significant rise in its share price over the past six months may suggest that the stock’s valuation is inflated. Note that management continues to expect strong growth going forward, with revenue this year expected to increase by at least 17% to $552 million. Adjusted EBITDA is also expected to be at least $57 million, implying year-over-year growth of at least 18%.

Nevertheless, these estimates suggest that the company’s stock currently trades at a lofty valuation of approximately 18 times forecast adjusted EBITDA. This represents a significant premium, especially considering that even by management’s estimates, the company’s adjusted EBITDA margin should be close to 10% of revenue, suggesting a thin margin of safety. ing. From a pure earnings perspective, Wall Street is expecting EPS growth of 19.7% to $0.71 for the year. However, even this estimate suggests a rich forward P/E of 35.6x.

I normally ignore egg companies trading at 35.6 times forward earnings, but I’m going to take this company’s flyer and give it a bullish rating. Contributing to the bull market already underway, investors expect revenue to grow very quickly through increased production, aggressive pricing, and Vital Farms building its brand in a commoditized field. I think you understand that you can do it. This allows the stock to easily grow to its valuation.

Of course, there are risks to this scenario, but it seems like a reasonable assumption given the company’s stellar track record to date.

Is Vital Farms stock a buy, according to analysts?

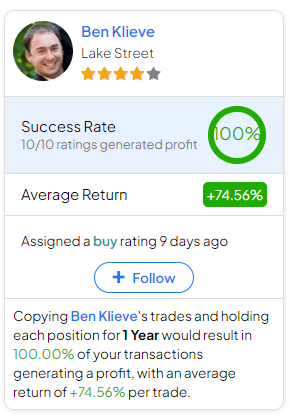

Despite my optimistic outlook, Vital Farms’ significant rally is raising some concerns among Wall Street analysts. The stock features a “Moderate Buy” consensus rating, based on his 6 buys and his 3 holds assigned over the past three months. However, Vital Farms’ average price target of $22.33 suggests a 12.9% downside.

If you’re wondering which analysts to follow when buying or selling VITL stock, the most profitable analyst covering the stock (over a 1-year period) is Lake Street’s Ben Krief, with an average return is 74.56%. The rating and success rate is 100%. Click on the image below for more information.

Take-out

In summary, I believe Vital Farms is an attractive investment opportunity for those looking to capitalize on the growing demand for high quality nutrition and ethically sourced food. The company appears to be gaining consumer trust with its focus on pasture-raised eggs sourced from family-owned farms and its overall commitment to transparency and sustainability. This is evidenced by its rapidly growing revenue and ability to increase prices without hindering sales volumes.

Additionally, while there are legitimate concerns about the stock’s valuation after such a significant increase, I believe Vital Farms’ continued momentum and strong earnings growth potential should allow the company to grow to that valuation. Either way, we think Vital Farms should only be considered by investors willing to buy into the long-term story, as valuation headwinds can impact short-term returns.

disclosure